In this article, we are going to define the step by step that follows an automatic trader to operate automatically.

Step 1: Think #

Like almost anything in life, when we want to do things right the first thing is to think. Think and plan. Think and plan.

In this first step, it is all about trader deciding the objectives he wants to achieve in automatic trading.

With objectives, we are referring to rentability and risk that we are willing to obtain, as a clear strategy to build. In this first step must be defined:

- Type of operation: Trend trading system, antitrend trading system, trading range system, volatility breakout, etc…

- Asset or asset type: Indexes, Forex, Commodities.

- Timeframe: timeframes (time of every candle) from 1 min or 5 min to timeframes of 1 hour, daily or weekly.

- Indicators to use: the appropriate indicators according to the strategy, for example, moving average for tendency or Bollinger for a range system.

Step 2: Define #

When it comes to defining an automatic strategy, we have to understand that a rule must be 100% unbiased. This means that we can not implement a rule when price increases “a little” or “a quite”, since this is an ambiguity that can not be programmed. Regarding the example mentioned before, it can be valid rules deciding to buy when the price increases 50 pips, or when the maximum is surpassed by the lastest 10 candles.

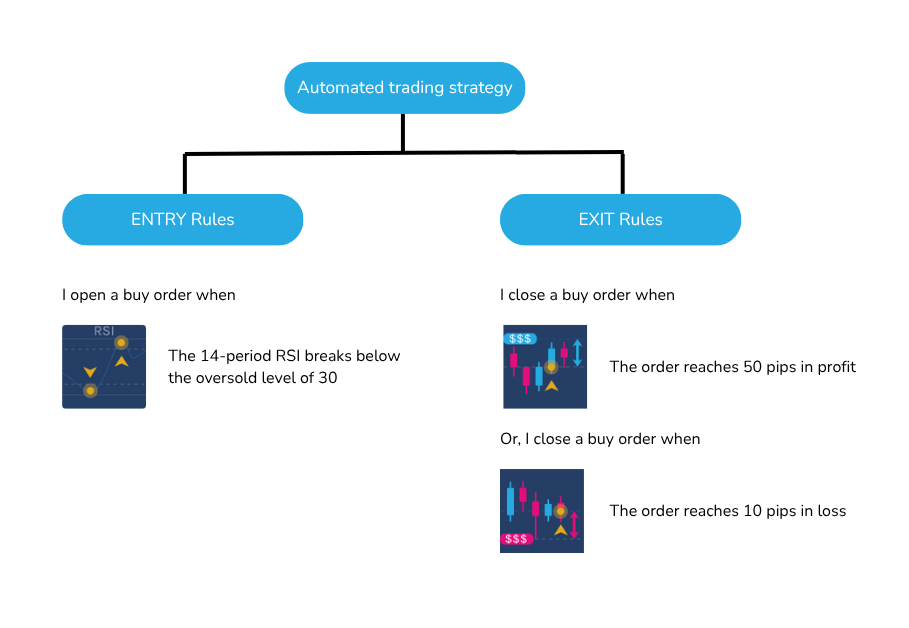

Every system has to be defined by entry and exit rules.

Moreover, just like in manual trading, it is HIGHLY recommended to define both profit and losses exit rules.

The definition part, we consider that it is not important to devote a lot of time. It will be enough to take the first idea about what we want to do. It will be enough to take the first idea about what we want to do.

(2a) Implementing #

Inside the defining step, we have a substep, implementation. In this step, we will talk about defining the algorithm. This point is one of the main barriers for those traders that have no programming notion.

In the article “Can I operate automatically without knowing how to program?” we give you some suggestions that can help you.

The ideal thing is to go from the idea in your mind to an algorithm that costs you as little time and money as possible.

Herramientas como tradEAsy os pueden ayudar precisamente a implementar estrategias de trading de forma fácil y rápida, sin saber programar.

Paso 3: Validate #

When we have thought our strategy and we have it defined, then the moment of testing it has arrived.

En este punto, entramos en uno de los aspectos más relevantes del trading automático, el backtesting.

Through a simulation, we are going to test, in a matter of a few minutes, the result that a defined strategy has according to the historical data of a concrete asset.

This characteristic allows the traders to have a huge knowledge about the repercussion of his rules in the market.

(3a) Learning by validating #

Regarding point 2, where we were recommended not to devote a huge effort to the system definition, is due to the learning capacity that backtesting offers us.

Once we have a result of a definition, we quickly learn the cause-effect of the system rules.

The usual thing is not achieving our result at the first validation, so it is more usual to do different hypothesis, test them with backtesting and continuously improving the method.

Step 4: Activate #

Once we get a system in accordance with the rentability and the risk we expect, the next step is activating the system in order to operate automatically.

Demo account: is highly recommended, especially if it is the first time we are going to operate automatically, that the automatic system activation is done in a demo account (simulated money). That way, we will activate our bot in real-time, with the prices in real-time, except for our money in our account that will be virtual. That way, we will activate our bot in real-time, with the prices in real-time, except for our money in our account that will be virtual.

In the scenario in which you decide to go directly to a backtesting system in a real account, we recommend you at least doing it with a lower ratio than the target.

In this step, we try to check if the system follows the evolution we were expecting.

Here you can see a guide to activate automatic systems in Meta Trader 4 (the so-called Expert Advisor).

Step 5: Analysis and tracking #

When we have an activated and functioning system, the automatic trader has not finished his task. It is one of his obligations to follow and analyse the automatic system functioning in the market.

The operation is indeed realized in an automatized way, but if we carry out an analysis and learn from it, then we could improve it with new hypothesis for validating.

Step 6: Iterate #

Taking advantage of the extra time that automatic trading gives us compared to the manual trading, due to the operation hours, an intelligent option is to leverage this time to create new systems or to improve the existing ones.

In this way, a unique manual trader could use a distribution of different automation systems operating simultaneously without supposing any added effort. This is a recommended dynamic for spreading out risk in different systems and generating a more efficient systems portfolio.

We end up with a visual outline of the 6 steps for operating automatically.