Definition #

The Fractal Dimension Index (FDI) is an indicator that helps measure the strength of a market trend. Its purpose is to determine whether the current trend (bullish or bearish) is strong or weak. Unlike other indicators that only show market direction, the FDI focuses on assessing the intensity of the trend.

Calculation #

The FDI is calculated using a mathematical formula that analyzes the price variation of an asset over a given period. The exact formula may vary depending on the implementation of the indicator, but it is generally based on the actual average price movement and the variation in its range.

Interpretation #

Interpreting the FDI:

- Value close to 1 – Indicates a certain trend, either bullish or bearish, with relatively stable price movement.

- Value close to 2 – Indicates a lack of a clear trend, with prices moving randomly or in a sideways range.

- Level 1.5 (default) – This value is considered a reference point to identify the start of a trend.

Early Trend Detection – The FDI is used to identify the direction and strength of a trend before it consolidates.

Operation Filter – The FDI can be used as a filter to confirm or reject an entry or exit signal.

Risk Assessment – The FDI can help assess the risk of a trade by indicating whether market conditions are favorable for a trend or not.

Example #

As we can see in the chart, below the graph is a moving line representing the FDI. When this line crosses the 1.5 point, it indicates a clear upward trend, prompting buy orders. This order will be closed when this same line crosses downward. The flags show the order’s movement until it closes.

Parameters #

Signal type

The element can operate in two modes. In trigger mode, it provides a signal the instant the element condition occurs. At all other times, even if the condition persists, trigger mode will not provide further signals (until a new condition is reactivated). In filter mode, it will provide a signal as long as the element is generating a signal.

These are the 2 options:

- Filter: while the signal is produced

- Trigger: at the moment the signal is produced.

NOTE: It is recommended to keep only one element with trigger signal type per rule, and the rest of the rule elements (optional) as filters.

Parameters configuration

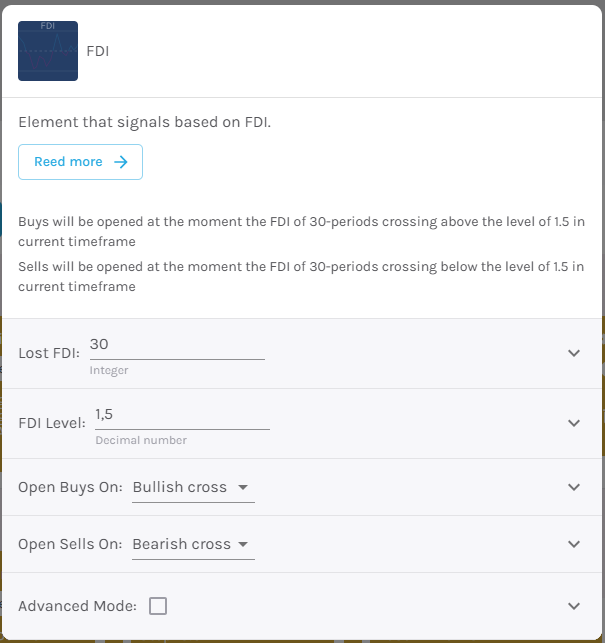

FDI Periods – Number of candles to be considered to give a signal [default: 30]

FDI Level – [default: 1.5]

Open buy order on – Select buy action, choosing between bullish or bearish signal [default: Bullish signal].

Open sell order on – Select sell action, choosing between bullish or bearish signal [default: Bearish signal].

Modo avanzado: Timeframe – Selecciona el Timeframe sobre el cual se aplicará el elemento. Estas son las opciones:

- Current: This refers to the timeframe associated with the strategy to be validated. For example, if our strategy is associated with the EURUSD in 15 minutes, the current timeframe will be 15 minutes. If we want to use this element with a different timeframe than the one used in the strategy, we can set it with the rest of the options.

- 1 min: 1 minute timeframe.

- 5 min: 5 minute timeframe.

- 15 min: 15-minute timeframe.

- 30 min: 30-minute timeframe.

- 1 hour: 1 hour timeframe.

- 4 hours: 4-hour timeframe.

- 1 day: 1 day timeframe.

- 1 week: 1 week timeframe.

- 1 month: 1 month timeframe.