Definition #

A trailing stop is a “dynamic stop loss” that follows the price. When entering buy positions, as the price rises, the trailing stop rises with it, always maintaining that distance. If the price falls, the trailing stop stays put. If the price falls to the trailing stop level, the trade is automatically closed, securing at least a portion of the profits you’ve accumulated.

Interpretation #

The trailing stop is a useful tool for:

- Lock in profits: Allows you to lock in profits as the price moves in your favor.

- Maximize profit potential: Unlike a fixed take profit, a trailing stop allows the trade to continue rising (or falling, in a sell) indefinitely, as long as the price doesn’t retrace too far.

- Risk management: Limits potential losses, as the stop loss is always adjusted to protect at least a portion of the profit.

- Automate Exit: Automatically closes the trade when the price pulls back far enough, which can be useful in volatile markets.

Parameters #

Signal type

The element can function in only one way. In trigger mode, it provides a signal at the instant the element condition occurs. For the rest of the time, even if the condition is maintained, the trigger mode will not give any more signals (until a new condition is reactivated).

NOTE: It is recommended to keep only one element with trigger signal type per rule, and the rest of the rule elements (optional) as filters.

Parameters configuration

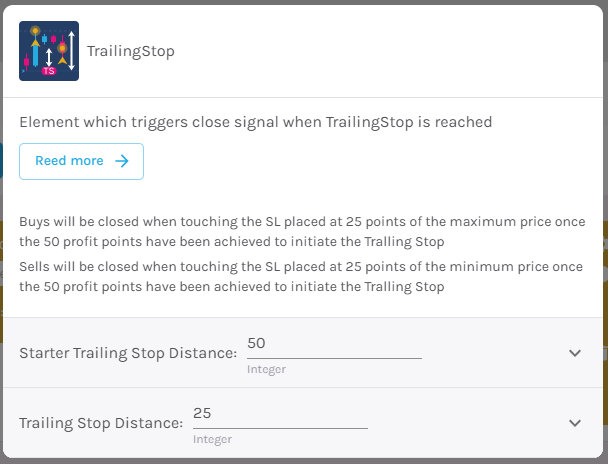

It can only be used to close orders, both purchases and sales.

Trailing stop start distance – Distance to activate the trailing stop.

Trailing stop distance – Distance to the trailing stop.