Definition #

An economic calendar is an essential tool that lists relevant economic events scheduled for release globally or for specific countries. It acts as an agenda for macroeconomic releases, monetary policy decisions, sentiment indicators, and other data that have the potential to influence financial markets. It provides traders and investors with an organized view of when these releases are expected and their potential impact.

Interpretation #

The economic calendar is a powerful tool for:

- Manage risk: Avoid opening or holding positions just before the release of high-impact events if you do not want to be exposed to such volatility.

- Planning trading strategies: You can base your decisions on market expectations and how the actual outcome deviates from the consensus. A significant surprise can create trading opportunities.

- Understanding economic trends: Tracking data over time helps you understand a country or region’s economy and identify potential changes in trends.

- Evaluate market sentiment: Market reaction to economic data can provide insight into overall investor sentiment.

Parameters #

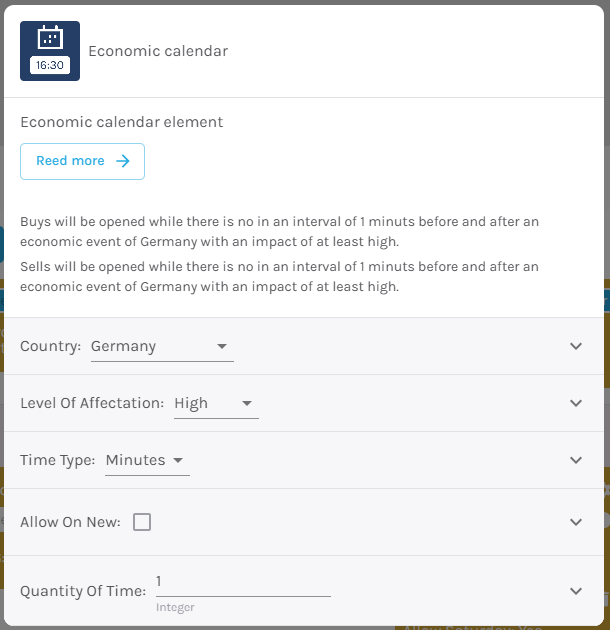

Country – The country we want to take into account when placing this element.

Level of affectation – There are 4 points to choose from:

Time Type – The time we want to set as the interval, whether seconds, minutes, hours, or days.

Allow on news – We can choose whether to operate while the event is taking place or not to operate at that time.

Amount of time – Time in numbers that we want to set as an interval during the event.