Definition #

The spread is the difference between the price at which you can buy an asset and the price at which you can sell it. It’s one of the ways brokers make profit. A spread filter is a rule that tells your trading platform to only execute orders if the asset’s current spread is within a limit you set.

Interpretation #

Using a spread filter has several advantages:

- Reduce transaction costs: Avoiding wide spreads means paying less to enter and exit trades, which improves long-term profitability.

- Avoid unfavorable market conditions: Spreads tend to be wider during times of high market volatility or low liquidity.

- Smarter automation: In automated trading systems, a spread filter can prevent trades from being opened when the cost of the trade is too high, improving the system’s efficiency.

Parameters #

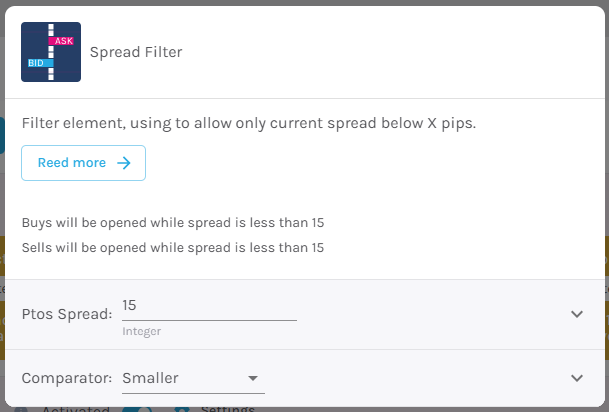

When setting up a spread filter, you typically specify a maximum acceptable spread value. When you attempt to open a trade, the platform checks the asset’s current spread. If the spread is equal to or less than the maximum value you set, the order is executed.

Spread Points – Number of points you want to put to open or close trades

Comparative – Choose between less than, less than or equal, greater than / greater than or equal.