Definition #

Losses are the actual money you’ve lost on your trading operations, reflected as a reduction in your available account balance. It’s the “net” decrease in your capital after all losing trades have been closed and commissions and other costs have been taken into account. It could be interpreted as the Stop Loss (SL), which is the point you set as the maximum loss on your trade. Once the trade reaches that price, it is automatically closed.

Interpretation #

It can be interpreted in three ways:

- Cash – This would be the loss obtained in the currency being used (e.g. € or $).

- Pips – A pip is the smallest movement an asset can make. For most currency pairs, a pip is the fourth decimal place (0.0001). For example, if EUR/USD rises from 1.1000 to 1.1001, that is a movement of 1 pip. For some pairs involving the Japanese yen (JPY), a pip is typically the second decimal place (0.01), for example, if USD/JPY rises from 135.00 to 135.01, that is a movement of 1 pip.

- Percentage – Based on the money you had available before the transaction or the money initially deposited into the account.

Cash losses are important for several reasons:

- Direct impact on capital: They show the actual reduction in funds available for operations.

- Measure the true cost of unsuccessful operations: Include all expenses associated with losses.

- Capital management: Controlling cash losses is essential to preserving capital and avoiding account depletion.

- Psychological aspect: Seeing how cash losses affect the real balance can help you make more informed decisions about risk management and strategy.

- Maximum Risk Control: By monitoring cumulative loss, a trader can ensure that he or she does not exceed his or her predefined loss limits for a day, week, or longer period.

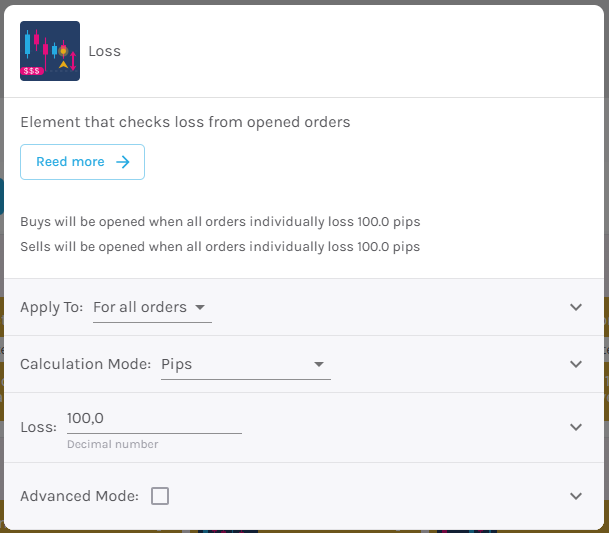

Parameters #

Signal type

The element can operate in two modes. In trigger mode, it provides a signal the instant the element condition occurs. At all other times, even if the condition persists, trigger mode will not provide further signals (until a new condition is reactivated). In filter mode, it will provide a signal as long as the element is generating a signal.

These are the 2 options:

- Filter: while the signal is produced

- Trigger: at the moment the signal is produced.

NOTE: It is recommended to keep only one element with trigger signal type per rule, and the rest of the rule elements (optional) as filters.

Parameters configuration

Applies to – It will be applied on three occasions:

- Order: It will apply unitarily for each order.

- For all orders: It will apply when all individual orders lose or win at least the specified amount.

- All orders: Will apply when all orders win or lose at least the specified amount.

Calculation Mode – It will be calculated in the form of pips, cash, active percentage or percentage of the account.

Losses – Amount of losses to be applied.

Modo avanzado: Timeframe – Selecciona el Timeframe sobre el cual se aplicará el elemento. Estas son las opciones:

- Current: This refers to the timeframe associated with the strategy to be validated. For example, if our strategy is associated with the EURUSD in 15 minutes, the current timeframe will be 15 minutes. If we want to use this element with a different timeframe than the one used in the strategy, we can set it with the rest of the options.

- 1 min: 1 minute timeframe.

- 5 min: 5 minute timeframe.

- 15 min: 15-minute timeframe.

- 30 min: 30-minute timeframe.

- 1 hour: 1 hour timeframe.

- 4 hours: 4-hour timeframe.

- 1 day: 1 day timeframe.

- 1 week: 1 week timeframe.

- 1 month: 1 month timeframe.