Definition #

Bill Williams’s Fractals are price patterns used to identify potential reversal points in the market. They are based on the idea that financial markets have a fractal structure, meaning the same basic patterns repeat themselves on different timescales.

Calculation #

A fractal is usually formed with a five-candle pattern:

- Bullish Fractal: A candle in the middle has a higher high than the two candles to its left and the two candles to its right. The high point of the middle candle is the bullish fractal.

- Bearish Fractal: A candle in the middle has a lower low than the two candles to its left and the two candles to its right. The low of the middle candle is the bearish fractal.

It is important to know that a fractal is not confirmed until the price breaks the high point (for a bullish fractal) or the low point (for a bearish fractal) of the middle candle.

Interpretation #

Fractals are used to identify potential market entry signals:

- Buy Signal: When a bullish fractal forms and the price then breaks above the fractal high, a potential buy signal is generated. This suggests that the price has found a low and now has upward momentum.

- Sell Signal: When a bearish fractal forms and the price then falls below the fractal low, a potential sell signal is generated. This suggests that the price has found a high and now has downward momentum.

Important Considerations:

- False Signals: Fractals can generate many signals, some of which may be false. For this reason, they are often used in combination with other Williams indicators, such as the Alligators.

- Delayed: Fractals are indicators that confirm after the price has broken out of the pattern, so they may have some lag.

- Time Frames: Fractals can be observed in different time frames, but their effectiveness may vary.

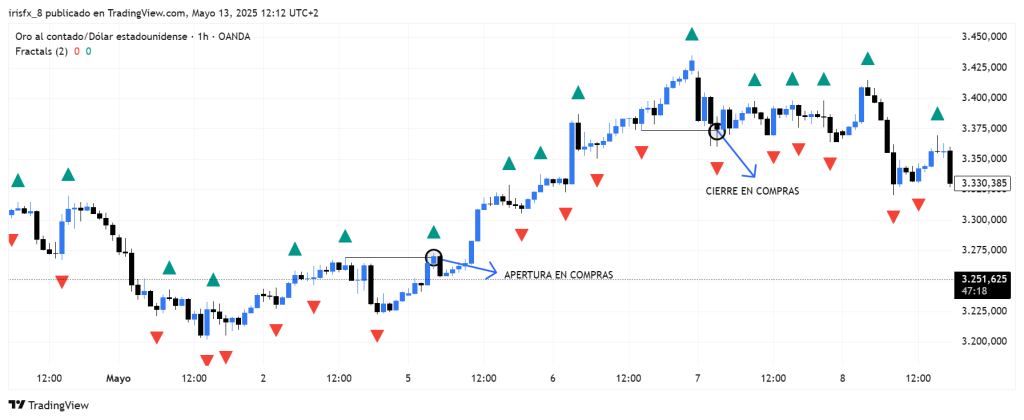

Example #

The red and green triangles show the fractals. In this case, a buy trade is shown. The moment it surpasses the previous fractal, the trade is opened.

The moment the fractal low is surpassed by another low, the purchase is closed.

Parameters #

Signal type

The element can operate in two modes. In trigger mode, it provides a signal the instant the element condition occurs. At all other times, even if the condition persists, trigger mode will not provide further signals (until a new condition is reactivated). In filter mode, it will provide a signal as long as the element is generating a signal.

These are the 2 options:

- Filter: while the signal is produced

- Trigger: at the moment the signal is produced.

NOTE: It is recommended to keep only one element with trigger signal type per rule, and the rest of the rule elements (optional) as filters.

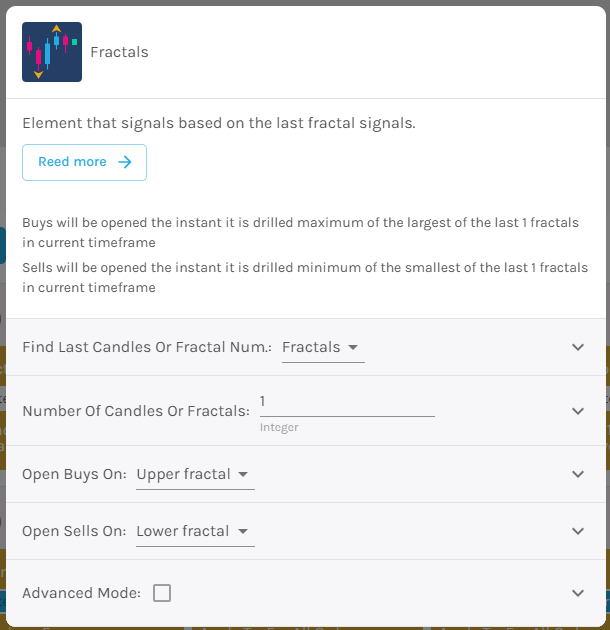

Parameters configuration

Number of candles to consider when giving a signal [default: 20]

Open buy position in – Select action to buy, choosing between upper fractal and lower fractal [default: Upper fractal].

Open sell position in – Select action to sell, choosing between upper fractal and lower fractal [default: Lower fractal].

Modo avanzado: Timeframe – Selecciona el Timeframe sobre el cual se aplicará el elemento. Estas son las opciones:

- Current: This refers to the timeframe associated with the strategy to be validated. For example, if our strategy is associated with the EURUSD in 15 minutes, the current timeframe will be 15 minutes. If we want to use this element with a different timeframe than the one used in the strategy, we can set it with the rest of the options.

- 1 min: 1 minute timeframe.

- 5 min: 5 minute timeframe.

- 15 min: 15-minute timeframe.

- 30 min: 30-minute timeframe.

- 1 hour: 1 hour timeframe.

- 4 hours: 4-hour timeframe.

- 1 day: 1 day timeframe.

- 1 week: 1 week timeframe.

- 1 month: 1 month timeframe.