Yes, the dynamic stop loss is a good way to define strategies where we do not have a clear profit objective, and we would want to allow the price a margin to make the impulse in the desired direction and close the position when a dynamic exit is generated.

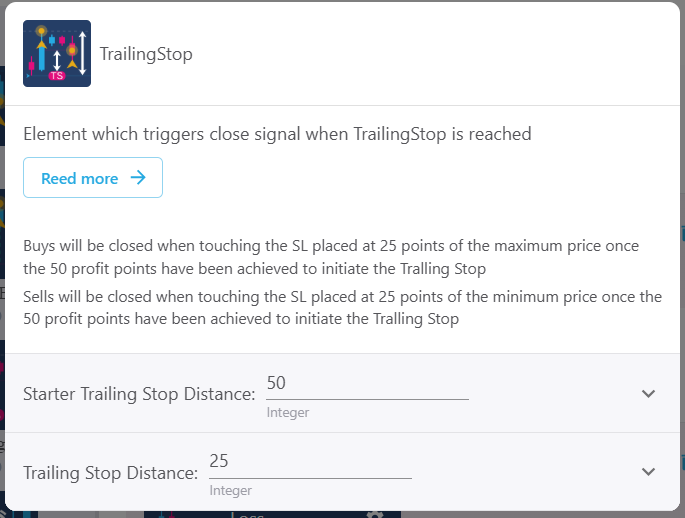

The more usual element for that is trailing stop, which will maintain our exit level with a margin distance respect the new profit levels that it will reach. You can check all trailing stop information here. You can find all the information about the trailing stop here.

However, you can use other elements as dynamic stop loss. For example, if we open an order with an entry condition of being above a moving average, we could establish an exit rule at the moment that the price crosses downwards the moving average. That way, as the price reached new maximums the exit level (the moving average) will move upwards until the price crosses downwards the moving average.