Definition #

The Williams %R is a momentum oscillator used in technical analysis to assess overbought and oversold conditions in an asset. It measures the position of the current closing price relative to the high-low price range over a specific period. The result is expressed as a negative percentage value ranging from 0 to -100.

Calculation #

The indicator analyzes the highest and lowest prices reached over a specified number of recent periods. It then calculates where the current closing price falls within the range mentioned above. A value close to 0 indicates that the closing price is near the high of the recent range, while a value close to -100 indicates that the closing price is near the low of the recent range.

Interpretation #

The Williams %R provides signals based on the following levels:

- Overbought Levels: Readings above -20 suggest the asset may be overbought, indicating a possible bearish reversal.

- Oversold Levels: Readings below -80 suggest the asset may be oversold, indicating a possible bullish reversal.

- Divergences: A lack of confirmation between price movements and those of the indicator can signal potential trend reversals. For example, prices reaching new highs while the %R doesn’t can indicate a bearish divergence.

- Failures: When the indicator enters overbought or oversold zones, but there is no immediate reversal, and then the indicator re-enters those zones, it may signal a continuation of the trend.

Example #

The moment the 14-period line passes the -80 point, a long position is opened, until this same line passes through the -20 point in a downward trend, indicating a possible reversal, which is the case in this case, so this long position is closed.

Parameters #

Signal type

The element can operate in two modes. In trigger mode, it provides a signal the instant the element condition occurs. At all other times, even if the condition persists, trigger mode will not provide further signals (until a new condition is reactivated). In filter mode, it will provide a signal as long as the element is generating a signal.

These are the 2 options:

- Filter: while the signal is produced

- Trigger: at the moment the signal is produced.

NOTE: It is recommended to keep only one element with trigger signal type per rule, and the rest of the rule elements (optional) as filters.

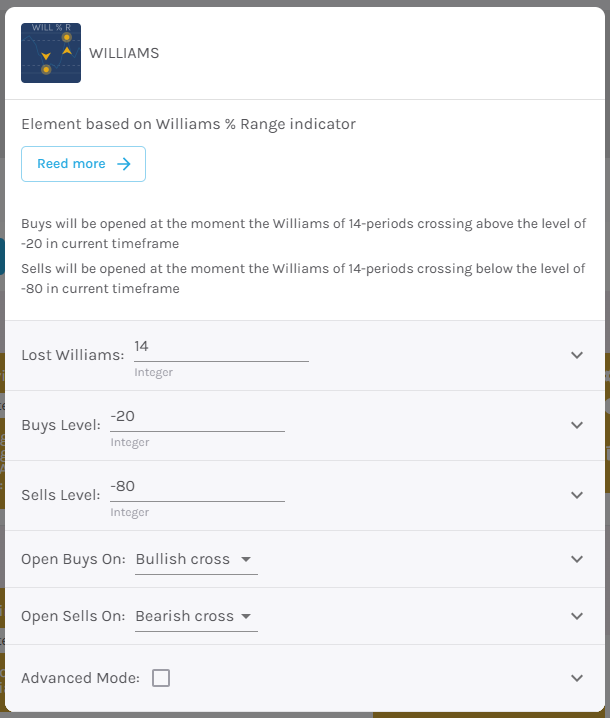

Parameters configuration

Williams Period – Number of periods of the Williams indicator [default: 14]

Purchase Level – Purchase level of the indicator [default: -20]

Open buy order on – Select buy action, choosing between bullish or bearish signal [default: Bullish signal].

Open sell order on – Select sell action, choosing between bullish or bearish signal [default: Bearish signal].

Modo avanzado: Timeframe – Selecciona el Timeframe sobre el cual se aplicará el elemento. Estas son las opciones:

- Current: This refers to the timeframe associated with the strategy to be validated. For example, if our strategy is associated with the EURUSD in 15 minutes, the current timeframe will be 15 minutes. If we want to use this element with a different timeframe than the one used in the strategy, we can set it with the rest of the options.

- 1 min: 1 minute timeframe.

- 5 min: 5 minute timeframe.

- 15 min: 15-minute timeframe.

- 30 min: 30-minute timeframe.

- 1 hour: 1 hour timeframe.

- 4 hours: 4-hour timeframe.

- 1 day: 1 day timeframe.

- 1 week: 1 week timeframe.

- 1 month: 1 month timeframe.