Definition #

The stop loss distance is the difference between your entry point and your exit point, where you assume a maximum loss. It’s the loss you set for your trade.

Interpretation #

Setting a stop loss distance is an important part of risk management and trade planning:

- Taking losses: Allows you to take losses in a controlled way without having to lose more than you are willing to, and also ensures that you do not lose your account.

- Establishing the risk/reward ratio: By comparing the take profit distance with the stop loss distance, you can assess whether the trade has a good risk/reward ratio. We shouldn’t take larger losses to obtain a smaller profit, as this will lead to a total loss of the account.

- Plan your exit strategy: Define in advance when to close the trade in case of losses.

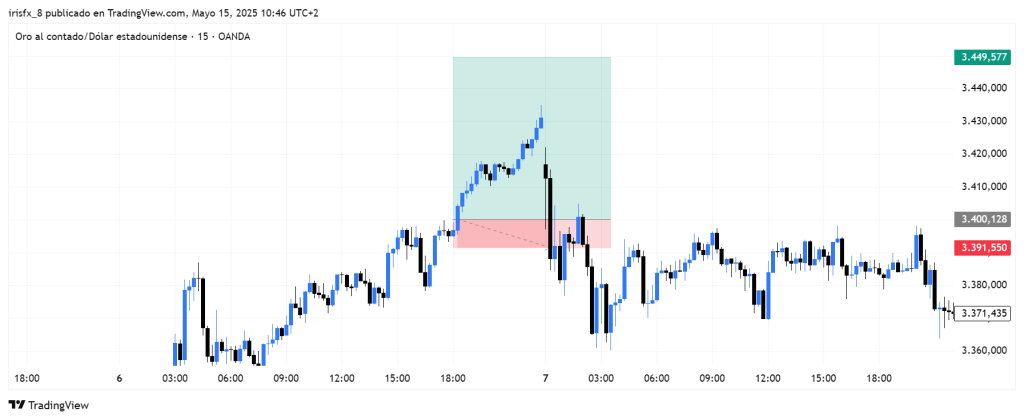

Example #