Definition #

The moving average crossover is a well-known strategy used to detect potential buying or selling moments in the market. It is based on the behavior of two lines called moving averages, which are simply averages of price calculated over different time periods. One line follows the price more closely (the fast one), and the other moves more slowly (the slow one). The key is to observe when they cross each other.

Calculation #

This strategy uses two moving averages: one short-term (e.g., 9 or 21 candles) and one long-term (e.g., 50 or 200 candles); each uses the average prices of the selected candles. These averages are plotted on the chart as lines that are updated with each new candle.

Interpretation #

When the fast moving average crosses upward over the slow moving average, it’s interpreted as the start of a possible uptrend. It’s as if the price is gaining momentum. Conversely, when the fast moving average crosses downward, it’s interpreted as a possible signal that a downtrend is beginning.

This type of crossover doesn’t guarantee that the market will move as indicated, but it does help provide an idea of where the trend might go. Therefore, many people combine this signal with other indicators or price action analysis.

Example #

This indicator is marked by two lines, the red 50-period line and the green 200-period line.

In this case, you can see a long trade, where it is opened at the moment the 50-period line crosses the 200-period line upwards, which indicates an upward trend.

The closing of this trade is determined by the next crossing of moving averages, but in this case the other way around: the 50-period line crosses downwards the 200-period line.

Parameters #

Signal type

The element can work in 2 ways. In trigger mode, it provides a signal at the instant the element condition occurs. For the rest of the time, even if the condition is maintained, the trigger mode will not give any more signals (until a new condition is reactivated). As for the filter mode, it will give a signal as long as the element is giving a signal.

These are the 2 options:

- Filter: while the signal is produced

- Trigger: at the moment the signal is produced.

NOTE: It is recommended to keep only one element with trigger signal type per rule, and the rest of the rule elements (optional) as filters.

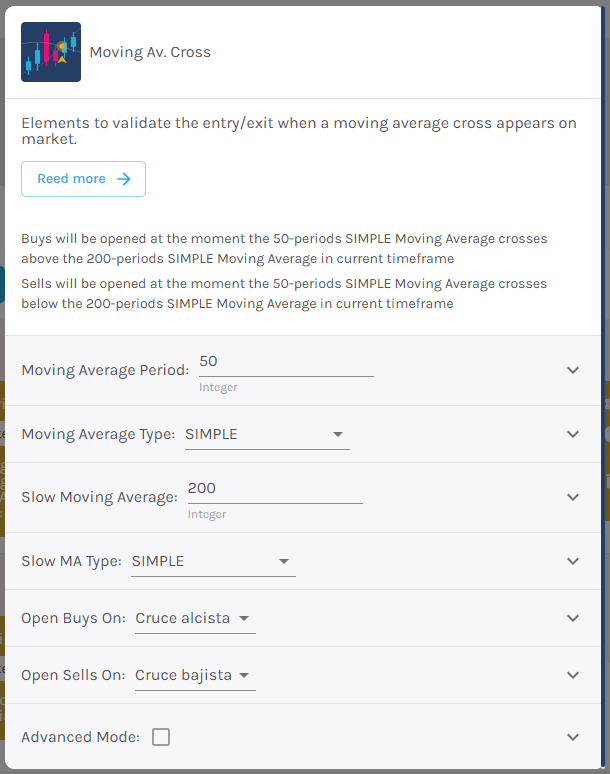

Parameters configuration

Fast Moving Average – Number of candles to consider to give a signal [default: 50]

Slow Moving Average – Number of candles to consider to give a signal [default: 200]

Average type – choose from simple, exponential, smoothed, and linear weighted.

Open buy order on – Select buy action, choosing between bullish or bearish signal [default: Bullish signal].

Open sell order on – Select sell action, choosing between bullish or bearish signal [default: Bearish signal].

Modo avanzado: Timeframe – Selecciona el Timeframe sobre el cual se aplicará el elemento. Estas son las opciones:

- Current: This refers to the timeframe associated with the strategy to be validated. For example, if our strategy is associated with the EURUSD in 15 minutes, the current timeframe will be 15 minutes. If we want to use this element with a different timeframe than the one used in the strategy, we can set it with the rest of the options.

- 1 min: 1 minute timeframe.

- 5 min: 5 minute timeframe.

- 15 min: 15-minute timeframe.

- 30 min: 30-minute timeframe.

- 1 hour: 1 hour timeframe.

- 4 hours: 4-hour timeframe.

- 1 day: 1 day timeframe.

- 1 week: 1 week timeframe.

- 1 month: 1 month timeframe.