Definition #

The CCI is an indicator used to determine whether an asset’s price is higher or lower than normal, based on its recent performance. It’s a kind of “deviation meter,” telling us whether the price has strayed too far from its average value. Although it’s called the “commodity channel index,” it can be used with any asset, not just commodities.

Calculation #

The CCI’s function is to compare the current price with the average of the prices of the last candles (usually 20). If the price is much higher than this average, the CCI will give a high value. If the price is much lower, it will give a low value. The result is expressed as a number that typically ranges between +100 and -100, although it can go outside this range during strong movements.

Interpretation #

When the CCI value rises above +100, it is interpreted as a higher-than-normal price and could be overbought, suggesting a possible correction. When the value falls below -100, it is considered a lower-than-normal price and could be oversold (i.e., having dropped too far and ready to rebound).

These levels are used as key zones. If the CCI moves into or out of these zones, it may signal an imminent change or continuation of the price movement. As with other indicators, it’s best to use it in conjunction with other tools to confirm signals.

Example #

As you can see in the image, the CCI is positioned below the chart, where a blue line moves based on the price of the last 20 candles.

In this case, we would have a sales transaction, marking the entry with a flag at the moment the line crosses 100 points from above, until the transaction ends at the moment it crosses below.

Parameters #

Signal type

The element can operate in 2 ways. In trigger mode, it provides a signal at the instant the element condition occurs. For the rest of the time, even if the condition is maintained, the trigger mode will not give any more signals (until a new condition is reactivated). As for the filter mode, it will give a signal as long as the element is giving a signal.

These are the 2 options:

- Filter: while the signal is produced

- Trigger: at the moment the signal is produced.

NOTE: It is recommended to keep only one element with trigger signal type per rule, and the rest of the rule elements (optional) as filters.

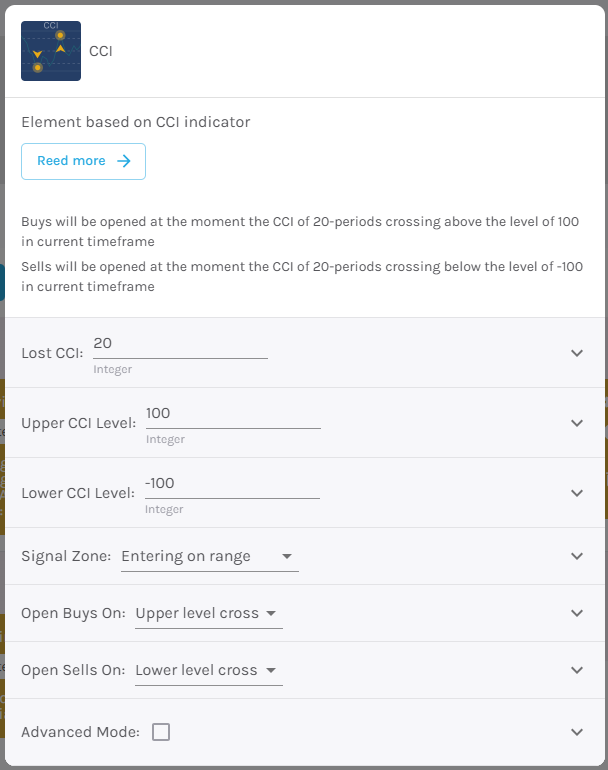

Parameters configuration

CCI Period – Number of candles to consider for signaling [default: 20]

CCI Upper/Lower Level – Levels to consider when opening and closing trades [default: 100 / -100; respectively].

Signal Zone – Enter above or below the selected level.

Open buy position at – Select action for purchase, choosing between upper level crossing and lower level crossing [default: Upper level crossing].

Open sell position at – Select action for sales, choosing between upper level crossover and lower level crossover [default: Lower level crossover].

Modo avanzado: Timeframe – Selecciona el Timeframe sobre el cual se aplicará el elemento. Estas son las opciones:

- Current: This refers to the timeframe associated with the strategy to be validated. For example, if our strategy is associated with the EURUSD in 15 minutes, the current timeframe will be 15 minutes. If we want to use this element with a different timeframe than the one used in the strategy, we can set it with the rest of the options.

- 1 min: 1 minute timeframe.

- 5 min: 5 minute timeframe.

- 15 min: 15-minute timeframe.

- 30 min: 30-minute timeframe.

- 1 hour: 1 hour timeframe.

- 4 hours: 4-hour timeframe.

- 1 day: 1 day timeframe.

- 1 week: 1 week timeframe.

- 1 month: 1 month timeframe.